Strategic land investment in the UK has the potential for generating significant increases in asset value during the investment lifetime. Strategic Land investment has been designed to provide landowners & investors with the opportunity to benefit from the unique circumstances presented by planning gain.

Using the skills and experience of a Strategic Team they focus on the most lucrative stage in the land development cycle. This is known as the ‘change of use’ or ‘re-positioning’ stage.

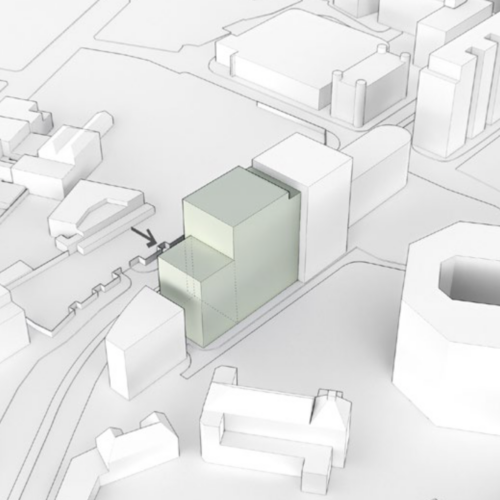

Land sites identified by the advisor as strategically important for future redevelopment, that may not have outline or detailed planning consent, are to be acquired with a view to increasing their value by promoting them through the re-zoning or change of use planning process.

This increase in value is known as planning gain enhancement, which significantly increases land value from its existing use to the new classification which predominately has a higher land value.

‘Only sites that qualify our strict investment criteria will be acquired. This is an integral component of the Advisors criterium as it removes the speculative nature of land investment, mitigates planning risk and significantly reduces risk to capital’.

The key objective is to add value to existing land through detailed planning promotion for our stakeholders.